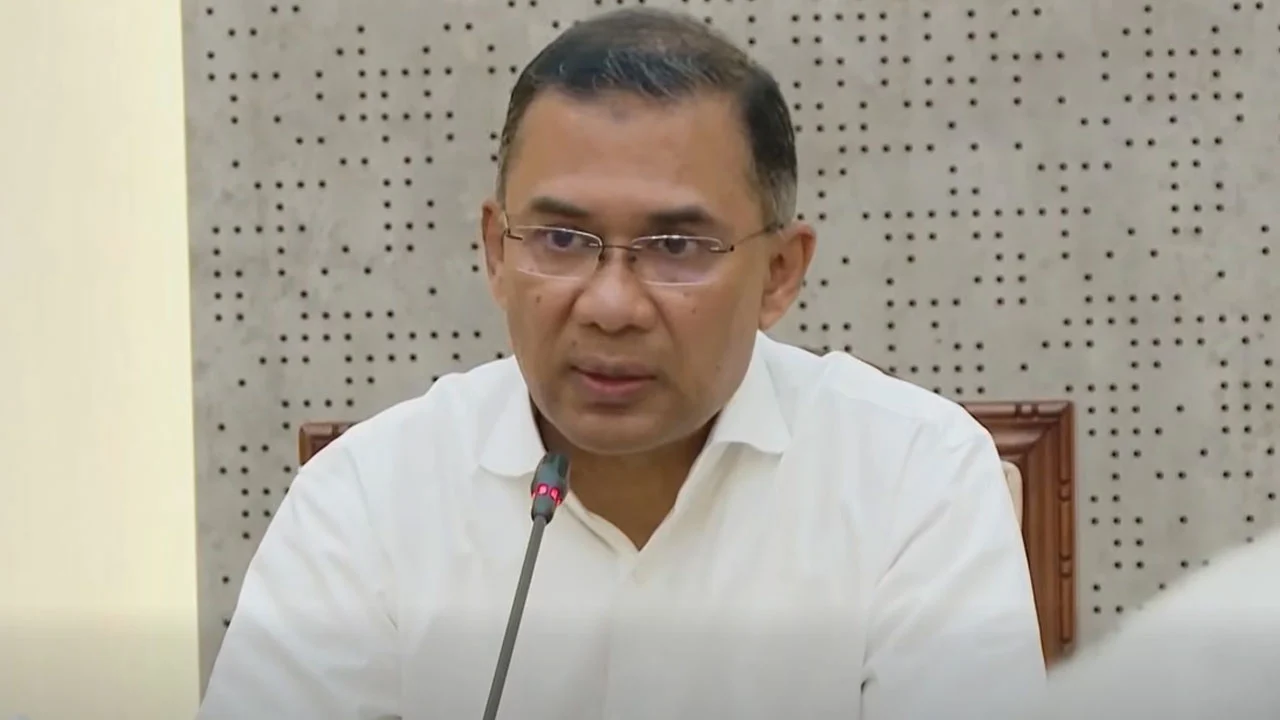

যুক্তরাষ্ট্রে প্রধান উপদেষ্টা ড. মুহাম্মদ ইউনূসের ব্যক্তি পরিচিতি থাকায় শুল্ক ইস্যুতে বাংলাদেশ বিশেষ সুবিধা পেয়েছে বলে মন্তব্য করেছেন প্রেস সচিব শফিকুল আলম।

শনিবার (২৩ আগস্ট) মার্কিন শুল্ক ইস্যুতে বাংলাদেশের অবস্থান ও চ্যালেঞ্জ বিষয়ক গোলটেবিল আলোচনায় তিনি এ মন্তব্য করেন।

শফিকুল আলম বলেন, শুল্ক কমিয়ে ২০ শতাংশ করতে শুরু থেকেই আত্মবিশ্বাসী ছিল অন্তর্বর্তী সরকার।Travel guide

তিনি আরও বলেন, শুল্ক আরও কমানোর চেষ্টা করা হবে। যুক্তরাষ্ট্রের সঙ্গে সামনে সম্পর্ক আরও উন্নত হবে। সেখানে রপ্তানি আরও বাড়বে।

প্রেস সচিব বলেন, নেগোশিয়েশনের সময় অন্যান্য মার্কেটের সঙ্গে প্রভাব কী হবে, সেটা মাথায় রেখেই দর-কষাকষি করা হয়েছে।

তিনি বলেন, যুক্তরাষ্ট্রে রপ্তানি বৃদ্ধির মাধ্যমে বাংলাদেশের অর্থনীতি আরও শক্তিশালী হবে।

প্রিন্ট

নিজস্ব সংবাদ :

নিজস্ব সংবাদ :